Creating a gifting profile

- Go to the unique gifting page and click on “Make a Contribution”

- Check the box to “Create a Gifting Profile”

- Enter your banking details and information as usual

- Create a login after completing your gift and verify your email

What is a gifting profile?

For easier gifting, family and friends can create a gifting profile to save their banking information and have their own personal dashboard with easy access to review their gifting history and receipts.

How do I access my gifting page?

A gifting page is automatically created when you establish an account. It is a unique web page that allows family, friends, organizations and others to easily make contributions directly to your account online. They can simply go to your unique gifting page URL and add funds to your account.

You can access your gifting page by signing in to your account and looking for the “View gifting page” on your overview page.

You can set a limit on gifts, so you don’t over contribute to your account.

How do I set up and access my account?

- Online: You can create and customize your account on the ABLE United website. Once you have created your account, you simply need to log in online to manage your funds.

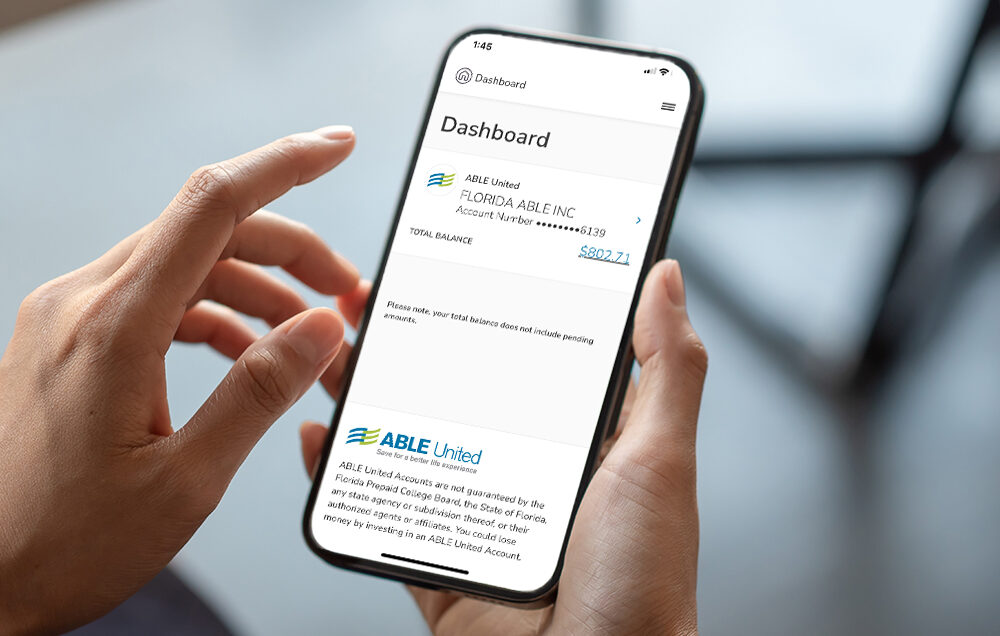

- Mobile app: If you already have an account, you can download the Vestwell app and log in using your ABLE United account username and password. You can then make withdrawals, contributions, and more whenever and wherever you want. Download the app today.

What is a successor designated beneficiary?

A successor for an ABLE United account must be a sibling, step-sibling or half-sibling of the account Owner and must also qualify for an ABLE United account. A successor must be added to the account before the death of the beneficiary.

When is IRS Form 5498-QA available?

The 5498-QA will be sent via mail or electronic delivery, based on your communications preference, by March 15.

When is IRS Form 1099-QA available?

The 1099-QA will be sent via mail or electronic delivery, based on your communications preference, by January 31.

What is IRS Form 5498-QA?

If a contribution is made to your account, you will receive IRS Form 5498-QA. This tax form details all contributions made throughout the tax year to your account, including contributions, rollovers and direct program-to-program transfers.

ABLE United is required to file all account information with the IRS; this is a record of that information.

To discuss your unique situation, please consult a tax adviser.

Learn more about Form 5498-QA from the IRS.

What is IRS Form 1099-QA?

If you make a withdrawal from your account, you will receive an IRS Form 1099-QA. This tax form details all withdrawals made throughout the tax year from your account.

Generally, if withdrawals from the account are used for the Beneficiary’s Qualified Disability Expenses, the earnings portion of the withdrawals are not subject to federal income taxation. To discuss your unique situation, please consult a tax adviser.

Learn more about Form 1099-QA from the IRS.

Where can I use the ABLE Visa Prepaid Card?

The ABLE Visa Prepaid Card can be used everywhere Visa debit cards are accepted, online and in stores.

You may not use your ABLE Visa Prepaid Card for online gambling or illegal transactions. Please see the Cardholder Agreement for other limitations. Similarly, the Authorized Legal Representative may put additional limitations on card activity using the True Link system.

If you believe your ABLE Visa Prepaid Card or any other access information has been lost or stolen, immediately call 1-888-219-9054.

Featured Content