When it comes to planning for the financial future, there are plenty of savings options out there. But if you or a loved one has a disability, it’s essential to explore the various options to understand how they might meet your unique needs. Three popular choices include ABLE accounts, traditional savings and checking accounts, and special needs trusts. Each option has benefits, but ABLE United accounts provide distinct advantages for Floridians with disabilities.

Let’s explore how an ABLE account can make all the difference for you and your family.

ABLE Accounts

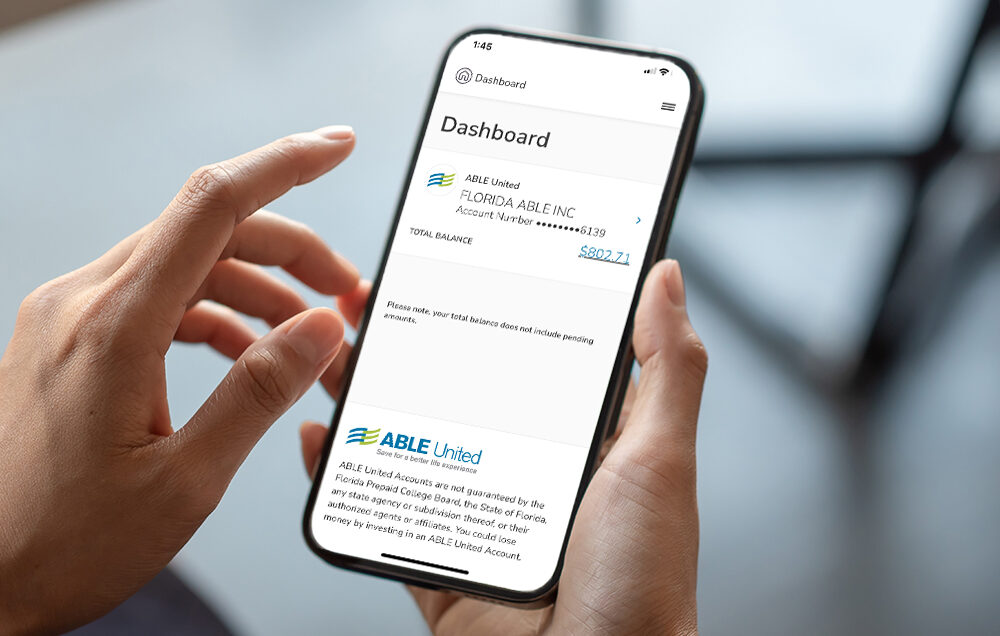

ABLE accounts offer a tax-free savings option specifically for individuals with disabilities, allowing families to save for various expenses like education, housing, and health care while maintaining eligibility for benefits like Medicaid and Supplemental Security Income (SSI). Contributions to ABLE accounts grow tax-free, and withdrawals for qualified expenses are also tax-free, providing significant financial advantages. Moreover, ABLE accounts offer flexibility and control, allowing account holders to manage their funds independently or with the help of a designated administrator.

Traditional Savings and Checking Accounts

Traditional savings and checking accounts are simple and accessible, but lack protections for individuals with disabilities. Savings over $2,000 can disqualify someone from receiving benefits like SSI, and these accounts don’t offer the tax advantages of ABLE accounts, making them less efficient for long-term growth.

Special Needs Trusts

Special needs trusts (SNTs) are vital for financial planning, allowing families to save for a beneficiary’s needs without losing government benefits. There are two types: first-party and third-party trusts. Although SNTs provide strong protection and cover many expenses, they involve complex and costly legal processes. Managing funds in SNTs can also be more challenging compared to the ease of ABLE accounts.

Empowering Financial Futures

While traditional savings accounts and SNTs each have their place in financial planning for individuals with disabilities, ABLE United accounts offer a unique combination of benefits that make them an outstanding option for Achieving a Better Life Experience. By providing tax advantages, protection for government benefits, and ease of use, ABLE accounts empower individuals with disabilities and their families to save and invest with confidence.

Ready to take charge of your financial future?

Try our Savings Calculator to see how you can meet your goals with ABLE United!

Back to Blog

Back to Blog